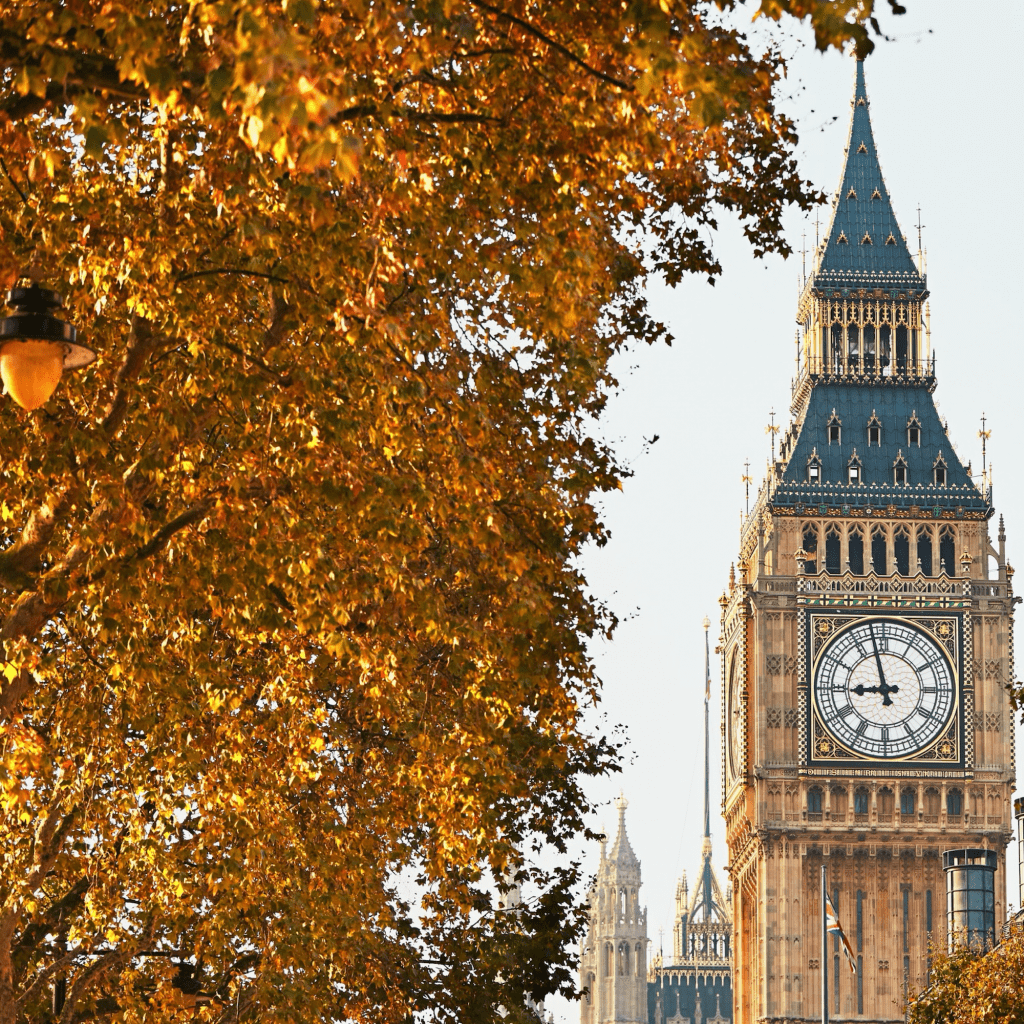

An unexpected windfall for the government has provided more than autumnal colour to the statement which had followed a better-than-expected economic and fiscal forecast by the Office of Budget Responsibility.

Chancellor Jeremy Hunt delivered his Autumn Statement for 2023 where he said his priorities are to avoid big government spending and high taxes and instead reward ‘hard work’ together with targeted measures to help businesses grow. The Autumn Statement is, of course, the Chancellor’s main opportunity outside of the Spring budget to change taxes and make spending announcements. The measures announced yesterday are clearly aimed at reviving the UK’s struggling economy together with perhaps an attempt to bolster the Conservative Party’s election chances next year.

So what was in it for the Umbrella worker? There were some key announcements such as the reduction in NI by 2% – this is probably the standout announcement for anyone employed by an umbrella company as it will save an average worker £450 per year. Many of you use salary sacrifice to fund your own pensions and to mitigate against additional rate and high-rate tax but it will be possible to really strengthen the value of this NI reduction. The NIC saving for someone earning over £50k will be just over £60 per month. If you sacrifice £166 per month of your headline agency rate the actual cost to you will be around £58 (after PAYE and NIC’ and AL). This cost is met by the reduction in NIC so no cost to you but £2000 per year extra into your pension.

It was interesting to see that the NI reduction will take effect from January and no doubt today all payroll software providers have cancelled any extended Christmas holiday as they will need to busy themselves to update all systems to manage this change.

State Pensions received a boost and we also saw an interesting announcement that savers could be given the right to choose the pension scheme that their employer pays into. It seems Jeremy Hunt does have a certain ‘soft spot’ for pensions – given that he also increased the annual pension allowance to £60,000 pa in his Spring Budget.

For businesses, it was expected that the Chancellor would make Business investment tax relief – ‘ full expensing’ permanent and he delivered on that. Full expensing is a capital allowance tax scheme allowing companies to deduct 100% of the cost for equipment from their profits – equivalent to a tax saving of 25p in every £1 spent. Some of our workers are transitioning back outside IR35 via a limited company so this is something that can be considered if you are looking at purchasing IT equipment.

Perhaps the Spring budget will bring a broader range of changes as the country gears itself for a general election in a time of fiscal restraint.

Have a good, if possibly frugal, Christmas.